The 10 Best Payment Gateways for Ecommerce

If you are thinking about creating an online store and are looking for a payment gateway to carry out transactions, in this comparison, you will find an analysis of the best payment gateways for Ecommerce.

To generate trust and security of customer data when making an online payment, it is essential to use a payment gateway. As Ecommerce grows faster, more gateways, services and payment methods appear that the user is increasingly accustomed to using.

What is a Payment Gateway?

Payment gateways act as a bridge between e-commerce websites and payment processors, transferring sensitive information such as credit card details needed to complete digital transactions online.

In eCommerce, it is an important and mandatory point, as it allows you to receive payments 24/7 , ensure the security and protection of the buyer’s data and save resources in the online management of your transactions.

Do not confuse a payment gateway with a payment method , such as the increasingly popular wallets or virtual purses (such as Apple Pay or Google Pay), which simply allow payment between individuals or companies.

How do Payment Gateways Work?

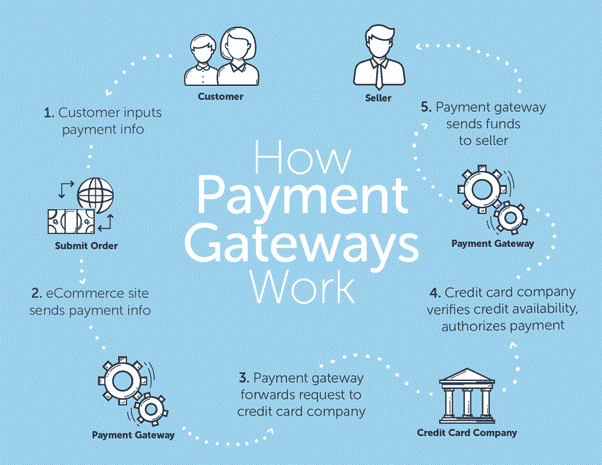

Many online payments begin when:

- The customer makes the purchase : The user enters their credit or debit card information in the shopping cart, usually through a form integrated into the website or mobile application. The encrypted payment data entered on the website is sent to the processor through the payment gateway.

- Bank encrypts and validates payment data : The payment gateway notifies the bank that issued the customer’s credit or debit card to ensure that there are sufficient funds in the associated account, and the transaction is authorized or declined.

- Payment authorization or rejection : The payment processor then communicates the authorization or rejection to the payment gateway, and the gateway communicates that information to the ecommerce site. If authorized, the customer receives an order confirmation, usually in the form of an email receipt.

- Payment approval and settlement of funds : The funds to make the purchase are deducted from the customer’s bank or credit account and transmitted to your ecommerce.

- Commissions and additional services : Payment gateways usually charge a commission for their services, which can be a percentage of the transaction amount or a fixed commission per transaction. Additionally, payment gateways can offer additional services such as fraud detection, chargeback management, and reporting and analysis.

What is the Best Payment Gateway for an Online Store?

Below you will find a summary of the best payment gateways for online stores.

- PayPal : One of the most used services for online payments.

- Stripe : Best in fees and API customization.

- Shopify Payments : Best for Shopify store owners.

- Verifone (2Checkout) : For sellers from any Latin American country.

- Square : Best overall for beginners.

- Amazon Pay : Best for Amazon users.

- MercadoPago : Best for local businesses in participating Latin American countries.

- Redsys: Platform with a long history in Europe.

- Adyen : Dedicated to international companies with large sales volume.

- Monei: Best fintech for the growth of E-commerce in Europe.

Best Payment Gateways for eCommerce

Choosing the right payment gateway tool can be overwhelming. Each processor has its operation and advantages specifically to meet the different needs of your business.

This is our top 10 of the best payment gateways for Ecommerce:

1.PayPal

Along with payments by credit or debit card, PayPal is the best-known and most popular payment gateway among buyers and Ecommerce in both countries.

All ecommerce platforms have simple integration and include all the necessary functionalities to manage payments, refund money, connect bank accounts and cards, as well as an encrypted system that makes transfers very secure.

If you have just started with your Ecommerce, it is a good option, since PayPal is not ideal for managing high-volume transactions.

Main advantages of PayPal:

- Supports recurring payments.

- Data security and encryption.

- Easy to integrate into your website.

- Currency exchange.

- Immediate transfers.

Commissions: PayPal does not charge opening or subscription fees. The only thing to keep in mind is that PayPal charges a sales commission on its operations and currency exchange between 2% and 4%. Visit their PayPal seller fees page detailed by market and country.

2.Stripe

Stripe is one of the best payment gateways used by millions of online businesses around the world regardless of their size. This means that it supports dozens of international payment options fully adapted to the customer’s language and device.

It is widely used as a payment gateway in Woocommerce, Prestashop and other open source platforms. If you are in Latin America, you should know that it is only available in certain countries , such as Brazil or Mexico.

Stripe Key Features:

- Very competitive rates.

- Generate financial reports.

- Compatible with any bank and card.

Commissions: Stripe fees depend on the area, being 1.4% for international transactions and 2.9% for international transactions, much lower compared to other alternatives such as 2Checkout, PayPal or MercadoPago.

3. Shopify Payments

Although it is only designed for Shopify , its use is increasing, since Shopify Payments offers security and confidence when receiving an online payment on this Ecommerce platform.

Easily integrates into your Shopify account admin. In fact, Shopify Payments is based on Stripe Software, (which provides back-end processing) and which now integrates more than 100 alternative third-party gateways (such as PayPal).

Shopify Payments Key Features:

- Native integration with Shopify.

- Designed for Ecommerce and physical stores (POS).

- Allow your customers to pay with Shop Pay, Google Pay and Apple Pay.

- Accepts several currencies depending on the country.

- 24/7 technical support.

At the moment, Shopify Payments is only available in certain countries. For Hispanic American users, it will be necessary to use one of the most popular payment gateways, such as Mercadopago or PayPal .

Fees : Shopify Payments eliminates the third-party payment gateway fee. From 0.25 per transaction plus a fee depending on your plan, which varies between 1.8% and 2.4%.

👉 In this guide we tell you the updated The 5 Best Alternatives to Shopify

4. Verifone (formerly 2Checkout)

Verifone , formerly known as 2CheckOut is a payment gateway with a presence in more than 200 countries. This makes it one of the most used payment gateways in Latin America and the best alternative to Shopify Payments in Spanish-speaking countries.

The platform offers more than 100 different currencies to its users and is an excellent option that facilitates international payments. However, it must be taken into account that the conversion rates for international payments into national currency are higher, usually around 2-5% higher than usual.

Main features of 2CheckOut:

- No registration fee.

- No monthly fee.

- Payment Gateway: 2Sell accepts all major credit card transactions such as Visa and Mastercard.

How much commission does 2Checkout charge?: The 2Checkout commission will depend on the product (physical or digital), country and business model , being between 3.5% and 6%. To this must be added a fixed fee of $0.35-0.60 for each payment.

5. Amazon Pay

The giant Amazon also has its own online payment service, Amazon Pay . It makes the purchasing process easier and faster by automatically adding the user’s shipping information and bank details with Amazon Sign-in .

Main features of Amazon Pay:

- Quick purchase process (with the possibility of payment in installments with Cofidis).

- Same protection against fraud that Amazon.es offers.

- Advantages for Amazon users.

- Improve the shopping experience with Amazon Pay Checkout v2.

The usual commission is around 2.7% and 2.4%, depending on the monthly volume of payments and an authorization fee of 0.35. Check the rate tables for each country for Amazon Pay .

6. Square

With Square , you can easily accept card payments in person and on your website. It is a great option for small stores that do not yet have an online presence.

It takes just a few minutes to create and verify a Square account and you can start using the payment gateway immediately. With Square Checking, you can access your money instantly or transfer it to an external bank account.

Square not only offers a payment platform, it also has the possibility of creating an online store with a catalog of items automatically.

Square’s active buyer protection against fraud and end-to-end encryption help keep your business and user data protected. Square also offers transaction dispute management.

Commissions : Square has transparent and easy-to-understand pricing. When customers make a purchase from your online store, you will have to pay a transaction fee of 1.4% + 0.25 for EU and EEA cards, or 2.9% + 0.25 for cards from the UK and outside the EEA. With the Premium plan, you can get more discount on these commissions.

Commissions for in-person purchases are slightly lower.

7. Payment Market

Mercado Pago is one of the best payment gateways to sell online in Latin America, which is part of Mercado Libre, the equivalent of Ebay or Amazon in Latin America.

It is available in the following countries: Argentina, Uruguay, Mexico, Peru, Brazil and Colombia and offers a solution that is easy to integrate into the main eCommerce platforms, such as WooCommerce. However, you will only be able to receive money in your local currency .

For example, if you are in Peru, you will only be able to receive payments in Soles. If you are in Argentina, Argentine pesos. If you plan to sell only in your country, it is a good option.

Main features of Mercado Pago:

- It allows you to add its plugin to Shopify, WooCommerce, Prestashop and WIX, among other virtual store creators.

- Multiple options to receive payments (QR code, payment link).

- No transaction fee on refunds.

Commission : Mercado Pago does not charge for withdrawing payments, only a commission on each completed transaction. This will depend on your country and is usually around 3.1-3.5% plus taxes, a somewhat higher rate than other payment gateways. Withdrawals usually take 1 day.

8. Redsys

Payment gateway Redsys is widely used throughout the country and offers a variety of highly functional services to facilitate e-commerce transactions.

Redsys acts as a Virtual POS and includes the management of payments with credit or debit cards, anti-fraud tools and verification systems. Furthermore, thanks to its popularity among Spanish banks, Redsys is an excellent option for carrying out transactions between national bank accounts quickly and safely.

Redsys also offers a number of additional features, such as 24-hour online technical support, downloadable payment templates and forms for added convenience, and compatibility with mobile and tablet devices.

The requirement to add the Virtual POS is to contract the service through one of Redsys’ client financial entities.

It should be noted that Redsys charges approximately 1% commission for each sale made through its platform and will depend on the agreement you make with your bank.

9. Adyen

Adyen is a Dutch payment platform that aims to be an all-in-one experience in Ecommerce, virtual POS and mobile payments. It has a group of high-profile technology and retail clients, such as Uber, Pinterest or Microsoft.

Naming these companies, you will wonder if it is software for small businesses. The answer is that you will need technical knowledge and patience to take advantage of its enormous capabilities.

On the other hand, it requires a minimum of transactions, so it works best for companies already established in the market and with a team dedicated to managing online purchases and payments.

Main advantages of Adyen as a payment gateway:

- +250 different payment types (credit cards, mobile wallets, Apple Pay and PayPal).

- Ideal for international online stores (Monthly minimum required).

- No registration or application fees.

- No monthly fee.

Commissions: Commissions vary depending on the country or payment method used with a Processing Fee of 0.11. You can check their pricing page for more information.

10. Monei

The Andalusian fintech, Monei, offers you to manage and process your payments with the following payment methods: Bank Cards, PayPal, Bizum, Google Play, Apple Play and payment in installments with Cofidis.

It easily integrates with the best e-commerce platforms and offers a very competitive price rate compared to the other payment gateways mentioned.

Main advantages of Monei:

- One of the cheapest rates and commissions per sale.

- Integration with the main ecommerce platforms and solutions.

- Payment by subscription for your online store with Cofidis or Klarna.

- Payment settlements in 1 day.

Commission : Monei is aimed at medium and large companies and there is no initial fee. Depending on your sales volume, Monei will calculate the rate to pay. The more payments you receive, the lower the commission will be. However, Monei’s lower fees are even cheaper than other payment gateways.

How to Choose the Best Payment Gateway for an Online Store?

There are a number of factors that any ecommerce business owner should consider before choosing a payment gateway: the level of security offered by the provider; the provider’s ability to process multiple payment methods; where your customers are located; and the costs and fees associated with using the service.

Security

For a secure payment process, your website will need an SSL certificate . This SSL certificate provides an additional “layer of security” when encrypting the visitor’s connection to your website.

Some ecommerce platforms hosted in the cloud (SaaS) have an SSL certificate and web hosting included, such as Shopify or Square. Other platforms such as WooCommerce, Prestashop and other open source software will need hosting and an SSL certificate to be configured.

On the other hand, your online payment provider must comply with PCI ( Payment Card Industry ) regulations. PCI stands for “ payment card industry ,” a set of standards that merchants must comply with to accept online payments. Compliance is required by credit card companies to ensure the security of credit card transactions passing through their processor and to protect buyers.

Accommodate multiple online payment methods

The payment gateway has to be able to process a variety of payment methods , not only credit and debit cards, but also PayPal and other payment options such as Apple Pay or Google Pay in order to increase the user experience in the payment process. Web.

Accept international payments

It is not necessary to select a payment platform that allows international transactions. However, if you plan to have clients abroad, it is best to select a service that can facilitate payments abroad.

The payment gateway will need to be able to support credit and debit cards from various foreign banks and allow users to convert payments into their country’s currency. The gateway should also offer support for navigating various tax systems.

Costs and fees

The costs associated with the use of payment gateways can be divided into three main components:

- Opening costs : Some payment gateways may charge an opening fee.

- Monthly subscription fee : They usually range between $10 and $50 and will depend on

- Commission per transaction : Processors usually charge between 1% and 5% of each transaction, in addition to a fixed commission that usually does not exceed 25 cents.

Conclusion

Selecting the best payment gateway for an online store is one of the most important decisions a business owner can make, so it is important to take into account all the needs of your business and your customers, along with your financial circumstances.

Do you know of any payment gateway that is not on this list? Tell us in comments!